Corporate social responsibility

AXA Emerging Customers: Business with social impact

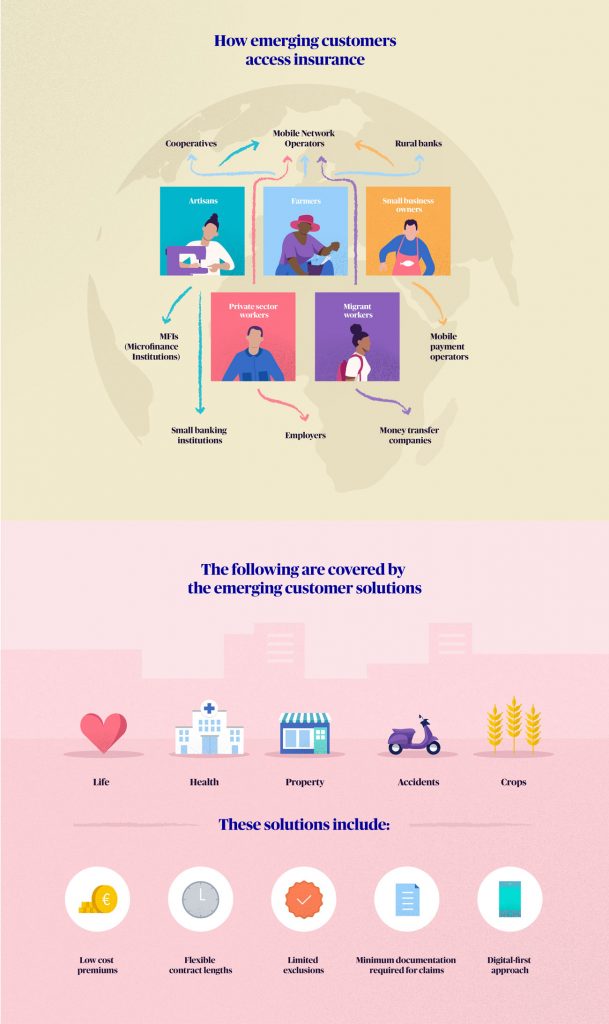

Ensuring emerging customers in Nigeria gain access to protection for their families, businesses and communities.

What do they all have in common?

Emerging customers live in emerging countries, they work hard to provide for their families and strive to give their children better opportunities through education. Their incomes are irregular, making them part of what some have coined the “middle of the pyramid”, the keystone of the active population in most of these markets.

AXA Mansard provides inclusive insurance covers to provide provided protection for the emerging customers via formal insurance.

Indeed, emerging customers are in a precarious intermediary position. Their income is often too high for them to be eligible for the limited social security nets which exist for the poor in their countries but have not quite reached the levels which would give them access to traditional private insurance. Many are in the informal economy, and as auto-entrepreneurs, owners of a micro, small and middle enterprises (MSMEs), they are not covered by employee benefits. Without protection, their transition towards the middle class therefore becomes a game of snakes and ladders, where they are always at the mercy of an illness, the theft of their bike, or a fire at their shop.

The fact that most emerging customers do not have formal insurance does not mean that they are not aware of their risks – they manage them in other ways. More often than not they rely on friends and family during rough times, cash saved under the mattress and tangible assets that can be sold quickly and easily. But managing risk through informal methods has its limits. Friends and family are not always able to entirely cover unattended costs.

Why is traditional insurance not accessible to Emerging Customers?

It all stems from the way insurance products are designed, distributed and operated. Often, insurance policies are complex and drafted in technical terms not adapted to the limited financial literacy of this customer base. Enrolment may require health forms to fill out, while long waiting periods and exclusions form another barrier.

In addition, Emerging Customers often have volatile revenues and do not always know what tomorrow will look like. Long-term policies are therefore ill-adapted. Finally, traditional insurance distribution focuses a lot on agents and brokers who mostly cater to higher-end customers in urban areas. Moreover, employee benefits are not available for lower income workers, who are often in the informal economy.

Reinventing insurance: An inclusive business model in practice

Tailoring insurance to Emerging Customers’ needs means reinventing our business model to overcome barriers of cost, access, understanding and trust. This entails products which are:

- Affordable: introducing flexibility in cover levels helps match emerging customer’s income levels, and offering monthly premium options suits their cash flows.

- Accessible: emerging customers can be hard to reach, as many of them are in remote areas and aren’t likely to knock on the door of an insurance agent. To overcome this barrier, AXA Mansard set up partnerships with microfinance institutions, mobile network operators and many others to offer protection to their customers.

- Aspirational: Insurance must help emerging customers in their transition to the established middle class. AXA Mansard Emerging Customers is committed to delivering social impact, and the team co-creates products with clients through field research, ensuring that the products meet the needs of clients.

- Understandable: for first-time buyers of insurance, education about how insurance works is critical. We simplify terms and conditions so people are not denied claims on the basis of hard to grasp exclusions such as “pre-existing medical conditions” or “hazardous occupations”. We remind our customers and their beneficiaries of their cover and how to use it.